Minimum Requirements to Get a Car Loan (With Any Credit Score)

A lot of customers email us asking how to get approved for a car loan, what the minimum requirements are, and if it's possible even with bad credit...

Many car shoppers don't want to apply for auto finance if they think they might get declined. Without the certainty of approval, they don't want to waste their time with tedious paperwork if it's just going to end in disappointment. Fortunately, car finance is more accessible today than it's ever been.

Car loans are generally available from a financial institution (bank, credit union, etc.) or a car dealership. Canadians with less-than-perfect credit usually don't get approved for an auto loan through a major financial institution like a bank because banks don’t typically work with subprime car buyers (borrowers with a credit score below 650.)

Thankfully, many car dealerships across Canada are partnered with specialized lenders to make car finance accessible to all Canadians. It’s never been easier to get approved for a car loan (even if you have bad credit).

Minimum car loan requirements

- Income requirement: $1,800 per month. This can be combined income with a cosigner. We discuss more on income requirements below.

- Credit score: The better your score the easier it will be to access loan products with lower interest rates. However, these days, a good credit score is not essential to get approved.

- Driver’s license: You must hold a valid driver’s license. In some instances, this can be a learner’s license.

- Age requirement: The minimum age is either 18 or 19 depending on your province.

Apply with Canada Drives today and we'll connect you with the best car deals in your area!

What is the minimum income needed for a car loan?

In order to approve you for a car loan, some lenders will look at other factors besides your credit score, like your income. Typically, the minimum income for a person to qualify for an auto loan with low credit is $1,800 every month before taxes or deductions (i.e. CPP, EI, etc.).

To put your income requirements into perspective, here’s the breakdown:

|

Hourly Income: |

At least $10.50 per hour for 40 hours per week, or equivalent |

|

Weekly Income: |

At least $420 per week (before deductions) |

|

Bi-weekly Income: |

At least $845 every two weeks (before deductions) |

|

Twice per month: |

At least $900 twice per month (before deductions) |

|

Monthly Income: |

At least $1800 per month (before deductions) |

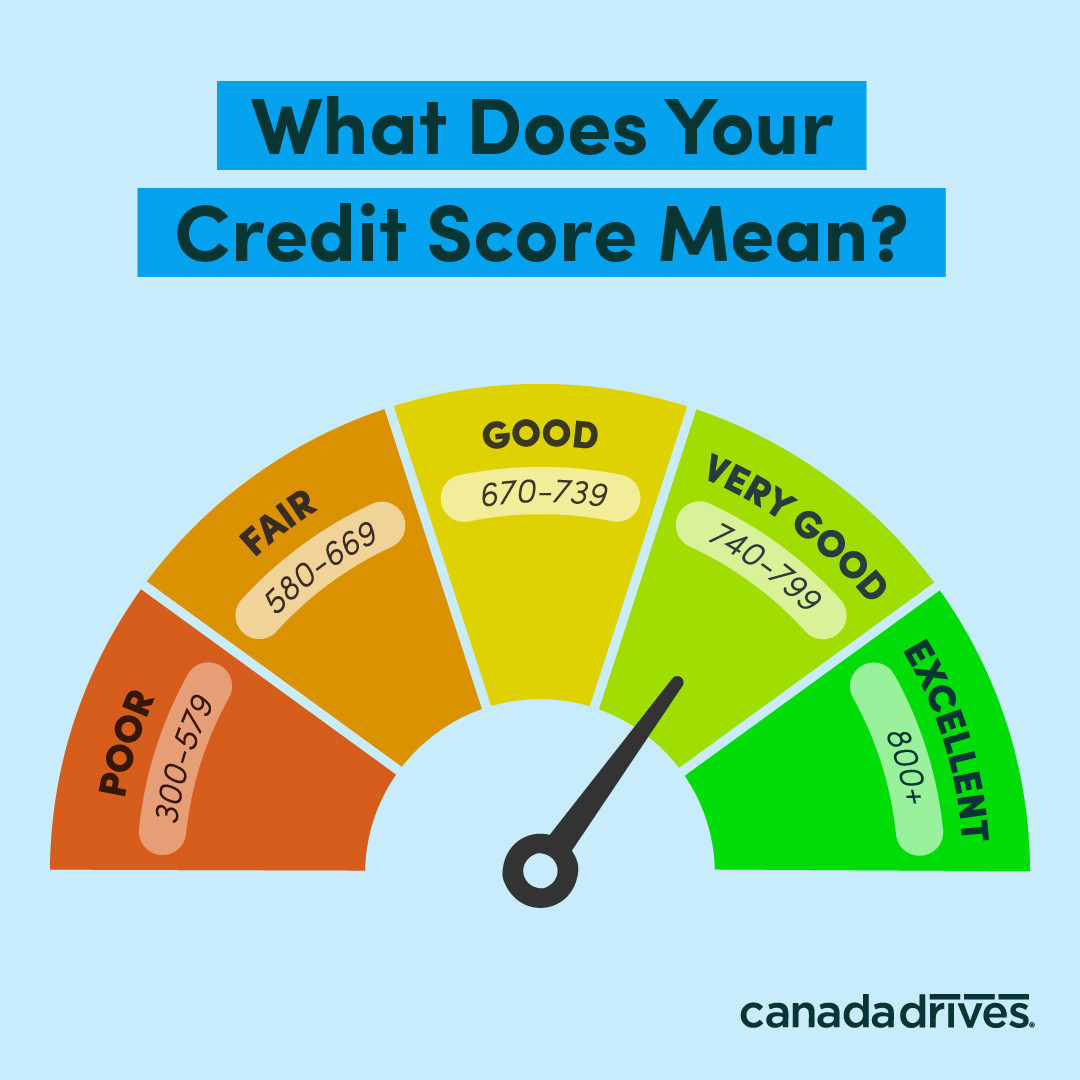

Credit score requirements

Thanks to the rise of specialized lenders, there is no minimum credit score to get a car loan. Banks may favour customers with good credit scores (670 and above), but a lender that specializes in subprime finance will look at your income and other factors alongside your credit report to determine your loan eligibility and rates.

But while your credit score may not be as important as it used to be for getting approved, the higher your 3-digit score is, the lower the cost of borrowing will be for you. Checking your credit report will give you an idea of what loan products and interest rates are available to you. Furthermore, regular monitoring will help you ensure there aren't any costly errors on your file. Read this article for pointers on how to check your credit report for FREE.

If you meet the income requirements mentioned above, Canada Drives can connect you with dealerships near you that know how to help. Visit Canada Drives right now to fill out our quick pre-approval application for FREE to see what great local deals you're eligible for!

What if I don't meet the income requirements?

If you have bad credit and don't meet the minimum income requirements in the table above, you should consider asking someone to cosign the car loan application. A cosigner is a close friend, partner, or family member who agrees to take responsibility for making the loan repayments in the event that you no longer can.

Document requirements

When you begin your car-buying journey, it's important that you have all of the documents ready to send to your dealer or bring with you to the dealership, including:

- Proof of income & employment history

- Driver's license

- Proof of insurance

- Vehicle documents for the trade-in (if you plan to trade in your existing vehicle)

If you’re applying for auto financing with no credit history, documents like bank statements, employment history and proof of paid bills such as phone statements or utility bills will show lenders that you’re responsible with your finances.

If you have a history of collections, bankruptcy, or a consumer proposal on your credit file, make sure you offer any paperwork associated with these to show lenders that you’re working on clearing the debt and paying back creditors.

Where do I start?

Regardless of your credit situation, Canada Drives can connect you with nearby dealerships that offer dozens of vehicle options to suit your budget and lifestyle. By getting pre-qualified for finance, you'll have your car loan organized before you visit the dealership! Simply apply in three minutes and Canada Drives will let you know what great car deals (including zero down options) are available to you!

Related articles

Does Financing a Car Build Credit?